The Essential Toolkit for Newly Registered RIA Firms: Keeping Compliance Simple, Automated, and Budget-Friendly

Blake Bjordahl

Compliance Technology Expert & RIA Consultant

Starting a new Registered Investment Advisory firm comes with a unique set of challenges. Between managing client relationships, developing investment strategies, and growing your business, the last thing you want is to get bogged down in complex compliance requirements. Yet with the SEC's increasingly stringent oversight and the costly consequences of non-compliance, getting your regulatory house in order from day one isn't optional—it's essential.

The good news? The right technology stack can transform compliance from a burden into a competitive advantage. Today's automated solutions make it possible for even the smallest RIA firms to maintain institutional-grade compliance standards without breaking the bank or hiring a full compliance team.

Key Topics for Reference

1. Manual Compliance is More Expensive Than You Think

Hidden costs add up fast – a typical 10-employee RIA spends $29,200 annually on manual compliance processes, consuming 652 hours of staff time (over 80 full workdays). These costs compound as you grow, creating scalability constraints, limiting business development.

2. Automation Delivers Immediate and Long-Term ROI

Comprehensive RegTech solutions can save RIAs over $9,000 annually and $45,000+ over five years while freeing up 572 hours for client-focused activities. Error rates can drop from 8-12% to less than 2%, dramatically reducing regulatory risk.

3. Integrated Solutions Beat Piecemeal Approaches

Managing multiple compliance vendors creates integration nightmares, security gaps, and hidden costs that can exceed 40-60% of advertised pricing. Single-source compliance platforms eliminate these issues while providing seamless workflows and unified reporting.

4. Speed of Implementation Matters More Than Perfect Solutions

Analysis paralysis is expensive in compliance. Every month you delay automation, you're spending thousands on manual processes while increasing regulatory risk. Start with core functionality and expand over time rather than waiting for the "perfect" solution.

5. Choose RIA-Specific Technology Partners

Generic compliance software wasn't designed for investment adviser requirements. Partner with providers who understand SEC regulations, IARD filings, custody rules, and marketing compliance rather than trying to adapt general business software to your unique needs.

The New RIA's Compliance Reality Check

Before diving into specific tools, let's address the elephant in the room: compliance costs. The average RIA spends between 5-15% of their revenue on compliance-related activities. For a newly registered firm with limited assets under management, this percentage can feel overwhelming.

However, the cost of non-compliance is far steeper. In 2024, the SEC imposed over $600 million in penalties for recordkeeping violations across more than 70 firms, with individual fines for investment advisers sometimes reaching into the tens of millions of dollars. Common infractions included inadequate recordkeeping, custody rule violations, and failures to properly disclose conflicts of interest. For a new firm, even a minor compliance slip could be business-ending.

This is where strategic technology investment becomes crucial. The right tools don't just reduce compliance costs—they prevent the catastrophic expenses that come with regulatory violations.

Core Compliance Areas Every New RIA Must Address

1. Books and Records Management

The SEC requires RIAs to maintain specific records for predetermined periods, with some documents requiring seven-year retention. Manual record-keeping systems simply cannot scale or provide the audit trail necessary for regulatory examinations.

2. Investment Adviser Representative (IAR) Supervision

Whether you're a solo practitioner or managing a small team, proper supervision protocols must be documented and consistently applied. This includes monitoring client communications, investment recommendations, and ongoing education requirements.

3. Cybersecurity and Data Protection

With the SEC's recent cybersecurity rules taking effect, RIAs must implement comprehensive cybersecurity policies and incident response procedures. Small firms often mistakenly believe they're not targets, but data breaches at advisory firms increased by 300% in 2023.

4. Marketing and Advertising Compliance

The SEC's updated Marketing Rule has strict requirements for testimonials, performance advertising, and social media presence. Every piece of client-facing content must be reviewed and archived.

5. Code of Ethics and Personal Trading Monitoring

All RIA firms must establish and enforce a code of ethics that includes personal securities transaction reporting and pre-clearance procedures for access persons.

The Hidden Costs of Compliance: Why Manual Processes Don't Scale

Before exploring technology solutions, it is crucial to understand the true cost of manual compliance processes. Many new RIA firms underestimate these costs, focusing only on obvious expenses like software subscriptions while ignoring the substantial hidden costs of manual workflows.

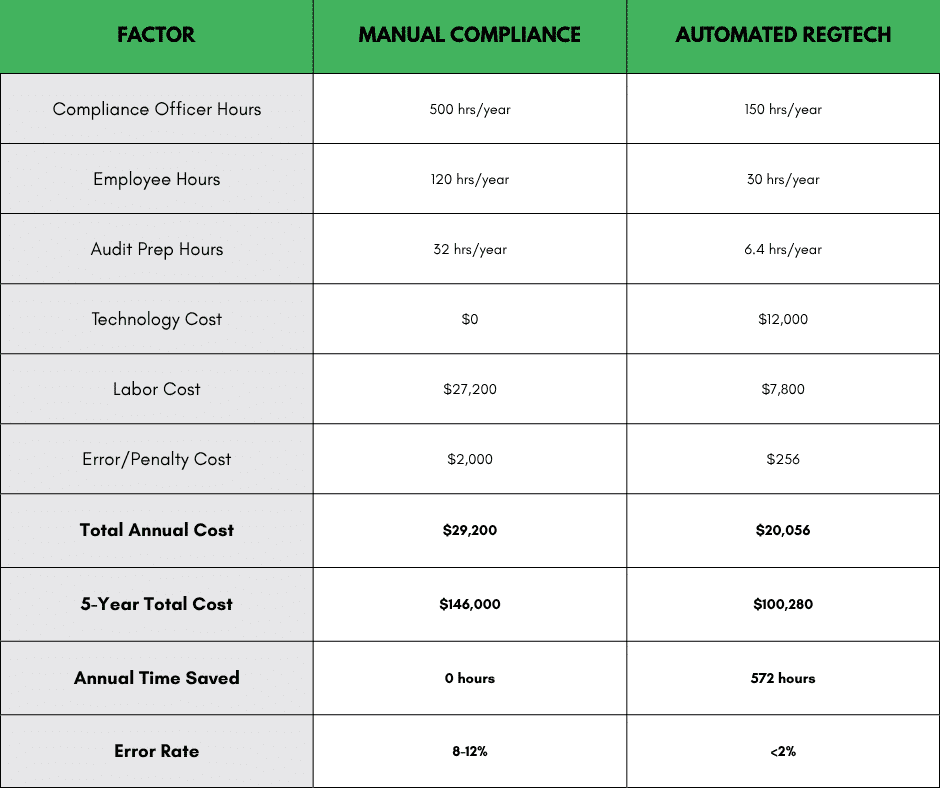

A Real-World Cost Analysis: Comprehensive Compliance Management

Consider this hypothetical scenario for a typical 10-employee RIA firm managing compliance across all required areas:

Manual Compliance Reality:

- Part-time compliance officer: 500 hours annually (10 hours per week at $40/hour)

- Employee compliance tasks: 120 hours annually (1 hour per employee per month for document submission, attestations, training)

- Quarterly audit preparation: 32 hours annually (8 hours per quarter)

- Error correction and penalties: Estimated $2,000 annually for missed deadlines and compliance gaps

- Total annual cost: $29,200

Automated RegTech Solution Results:

- Technology cost: $12,000 annually ($100 per employee per month)

- Reduced compliance officer time: 150 hours annually (70% reduction through automation)

- Reduced employee time: 30 hours annually (75% reduction in administrative burden)

- Reduced audit prep: 6.4 hours annually (80% reduction through automated documentation)

- Total annual cost: $20,056

Hypothetical Cost Comparison breakdown of a manual compliance process versus an automated RegTech compliance solution

The Bottom Line: Automation saves this 10-person firm over $9,000 annually while simultaneously freeing up 572 hours – equivalent to 71 full workdays – for client-focused activities. Over five years, the total cost savings exceed $45,000 despite the technology investment.

Additional Benefits Beyond Cost Savings:

- Error reduction: Compliance errors drop from 8-12% to less than 2%

- Proactive monitoring: Real-time alerts prevent violations before they occur

- Audit readiness: Centralized documentation reduces audit preparation time by 80%

- Scalability: Technology costs scale predictably with growth, unlike linear increases in manual compliance labor

This scenario illustrates a fundamental principle: manual compliance processes create hidden costs that compound over time, while automated solutions provide both immediate savings and long-term scalability advantages.

The Multi-Vendor Complexity Challenge

Most new RIA firms start by researching individual compliance tools – document management systems, cybersecurity solutions, communication archiving platforms, and compliance monitoring software. While this seems logical, sourcing multiple vendors for compliance management creates several hidden problems:

- Integration Nightmares: Different vendors rarely integrate seamlessly, leading to data silos, duplicate data entry, and workflow inefficiencies that eliminate much of the automation benefit.

- Vendor Management Overhead: Managing multiple vendor relationships, contracts, and support contacts creates an administrative burden that scales poorly as your firm grows.

- Training Multiplication: Each new tool requires separate training for your team, multiplying implementation time and reducing adoption rates.

- Security Vulnerabilities: Multiple systems mean multiple potential security gaps, each requiring separate monitoring and management.

- Cost Creep: Individual tool costs seem reasonable, but they quickly compound. A typical multi-vendor compliance stack can cost 40-60% more than integrated solutions when you include implementation, training, and management overhead.

Essentials to Look For in Compliance Technology

Rather than diving into specific vendor comparisons, new RIA firms are better off focusing on understanding core technology categories that need to addressing:

- Compliance Management and Monitoring – Automated tracking of regulatory requirements, deadline management, and violation detection across all compliance areas.

- Document Management and Retention – Secure storage, automated retention policies, and audit-ready retrieval systems for all required records.

- Communication Archiving and Monitoring – Comprehensive capture and analysis of all business communications with real-time compliance monitoring.

- Cybersecurity and Data Protection – Multi-layered security including endpoint protection, access controls, and incident response procedures.

- Personal Trading Monitoring – Automated collection, analysis, and reporting of employee personal securities transactions.

- Marketing and Advertising Compliance – Review workflows, approval processes, and archival systems for all client-facing materials.

- Regulatory Reporting and Filing – Automated preparation and submission of required regulatory forms and reports.

The Integrated Approach: Why Single-Source Solutions Win

The most successful RIA firms do not try to cobble together multiple point solutions. Instead, they partner with comprehensive compliance technology providers who understand the unique challenges of investment advisory firms.

Benefits of Integrated Compliance Technology

- Seamless Data Flow: When all compliance functions operate within a single platform, data flows seamlessly between modules. Personal trading data automatically populates compliance reports, communication monitoring flags potential issues in real-time, and document management systems maintain proper retention schedules without manual intervention.

- Unified Reporting: Instead of generating separate reports from multiple systems, integrated platforms provide comprehensive compliance dashboards that give you complete visibility into your firm's compliance status at a glance.

- Simplified Training: Your team learns one system instead of five. This dramatically reduces implementation time and improves user adoption rates.

- Consistent Security: A single security framework protects all your compliance data, eliminating the security gaps that inevitably occur when managing multiple systems.

- Scalable Growth: As your firm grows, integrated platforms scale with you. Adding new employees, clients, or services doesn't require evaluating and implementing new tools – your existing platform adapts to your evolving needs.

The RIA Compliance Technology Advantage

This is where specialized compliance technology partners become invaluable. Rather than spending months researching individual tools, negotiating separate contracts, and managing complex integrations, successful RIA firms partner with providers who offer comprehensive, integrated solutions designed specifically for investment advisers.

The key is finding a partner who understands that compliance technology should enhance your business operations, not complicate them. The right solution automates routine compliance tasks, provides early warning of potential issues, and frees your team to focus on client service and business growth.

1. Automated Compliance Calendars

Modern compliance platforms can automatically generate compliance calendars based on your firm's registration, client types, and service offerings. Tasks are assigned to appropriate team members with automatic reminders and escalation procedures.

Implementation Tip: Start with a basic compliance calendar template and customize it based on your firm's specific requirements. Most platforms offer pre-built templates for common RIA compliance requirements.

2. Automated Document Retention and Disposal

Proper document management requires both retention and disposal procedures. Automated systems can classify documents, apply appropriate retention periods, and automatically dispose of documents when legally permissible.

Cost Savings: Automated document management can reduce compliance-related administrative time by up to 75%, according to industry studies.

3. Intelligent Email and Communication Monitoring

AI-powered communication monitoring can flag potential compliance violations in real-time, allowing for immediate corrective action rather than discovering issues during annual compliance reviews.

Key Benefit: Proactive monitoring prevents minor issues from becoming major compliance violations.

4. Automated Regulatory Filing and Reporting

Modern platforms can automatically prepare and file routine regulatory reports, including Forms ADV updates, custody certifications, and state notice filings.

Time Savings: Automated filing can reduce regulatory preparation time by up to 80% while improving accuracy and reducing filing errors.

ROI Considerations for Compliance Technology

While the upfront costs of compliance technology might seem significant for a new firm, consider the long-term ROI:

Direct Cost Savings of Compliance Technology:

- Elimination of multiple vendor management and integration costs

- Reduced need for external compliance consultants

- Lower legal fees from proactive, automated compliance management

- Dramatic time savings from integrated workflows (as shown in our personal trading example: 75% reduction in compliance officer time)

- Reduced likelihood of regulatory fines and sanctions

Indirect Benefits of Compliance Technology:

- Faster time-to-market for new services due to automated compliance verification

- Improved client confidence from robust, professional compliance procedures

- Enhanced ability to scale operations without proportional compliance staff increases

- Competitive advantage in winning institutional clients who require sophisticated compliance infrastructure

- Better decision-making through integrated compliance analytics and reporting

Break-Even Analysis: Most new RIA firms see positive ROI from integrated compliance technology within 6-12 months, with the primary drivers being reduced external consulting costs and dramatic time savings for internal staff.

Best Practices for Implementing Compliance Technologies

Start with Integration in Mind

Rather than piecing together multiple point solutions, prioritize comprehensive platforms that handle multiple compliance areas within a single system. The time and cost savings from integrated workflows typically justify higher per-module costs and eliminate the hidden expenses of managing multiple vendor relationships.

Focus on RIA-Specific Solutions

Generic compliance software wasn't designed for the unique requirements of investment advisers. Look for solutions built specifically for RIA compliance that understand the nuances of SEC regulations, IARD filings, and advisory-specific requirements like the custody rule and marketing regulations.

Prioritize Automation Over Features

Choose solutions that automate your highest-risk, most time-consuming compliance activities rather than those with the most features. For example: A system that automatically monitors personal trading violations is going to be more valuable than one with dozens of manual reporting options.

Plan for Rapid Implementation

The compliance technology landscape moves quickly, and regulatory requirements continue to evolve. Choose partners who can implement solutions rapidly and adapt quickly to changing requirements rather than those requiring months-long implementation projects.

Common Implementation Pitfalls to Avoid

Trying to Build Your Own Solution

New RIA firms sometimes attempt to create compliance systems using generic business software or basic document management tools. This approach inevitably leads to compliance gaps and significant hidden costs in customization and maintenance.

Focusing Only on Initial Costs

The cheapest solution is rarely the most cost-effective. Consider total cost of ownership, including implementation, training, integration, and ongoing management costs. Integrated solutions often cost less overall despite higher upfront pricing.

Underestimating Implementation Complexity

Even the best compliance technology requires proper setup, configuration, and training. Budget both time and money for implementation, and choose partners who provide comprehensive support during the transition.

Delaying Implementation While "Researching"

Analysis paralysis is expensive in the compliance world. The longer you delay implementing proper compliance technology, the more you're spending on manual processes and increasing your regulatory risk. Start with core functionality and expand over time rather than waiting for the "perfect" solution.

The Future of RIA Compliance Technology

The compliance technology landscape continues to evolve rapidly, with several trends particularly relevant for new RIA firms:

Artificial Intelligence and Machine Learning

AI-powered compliance monitoring is becoming more sophisticated and affordable. These tools can identify potential issues before they become violations and provide predictive insights about compliance risks.

Regulatory Technology Integration

Expect increased integration between compliance platforms and regulatory filing systems, further reducing the administrative burden of regulatory compliance.

Enhanced Cybersecurity Automation

As cyber threats become more sophisticated, automated cybersecurity responses will become essential rather than optional for RIA firms of all sizes.

Client Experience Integration

Compliance tools are increasingly focusing on improving client experience rather than just meeting regulatory requirements. This includes streamlined onboarding, secure client communications, and transparent reporting.

Making the Investment Decision

For newly registered RIA firms, compliance technology represents a critical early investment that directly impacts both regulatory risk and business scalability. The alternative—managing compliance manually or through disparate point solutions—poses unacceptable risks in today's regulatory environment while consuming resources that should be focused on client service and business growth.

The key is to approach compliance technology strategically:

- Recognize that integration matters more than individual features – comprehensive platforms outperform collections of point solutions

- Prioritize automation of your highest-risk compliance areas first, particularly personal trading monitoring and communication oversight

- Choose RIA-specific solutions that understand your unique regulatory requirements

- Plan for growth by selecting partners who can scale with your firm rather than solutions you'll quickly outgrow

- Focus on speed of implementation – compliance risks compound while you're researching options

Taking Action: Your Next Steps Toward an Automated Compliance Process

Building an effective compliance technology stack doesn't happen overnight, but delaying the process increases both costs and risks. Here is your action plan:

This Week:

- Conduct a compliance risk assessment of your current manual processes

- Calculate your current compliance-related costs, including the hidden time costs shown in our personal trading example

- Identify your highest-risk compliance areas that would benefit most from automation

- Research integrated compliance technology providers who specialize in RIA requirements

This Month:

- Request demonstrations from comprehensive compliance technology providers

- Implement immediate cybersecurity measures (MFA, endpoint protection) if not already in place

- Create a technology budget that accounts for the total cost of ownership, not just subscription fees

- Develop an implementation timeline that prioritizes your highest-risk compliance areas

Next Quarter:

- Select and implement a comprehensive compliance management platform

- Establish automated workflows for your most time-consuming compliance activities

- Train your team on new systems and integrated procedures

- Conduct your first compliance technology review to identify additional automation opportunities

Remember, compliance technology is not just about meeting regulatory requirements—it's about building a foundation for sustainable growth. The firms that invest in robust compliance infrastructure from the beginning are the ones that scale successfully and avoid the costly compliance crises that can derail even the most promising advisory businesses.

The regulatory landscape will only become more complex, and client expectations for professional, secure service continue to rise. By implementing the right compliance technology stack from the start, you're not just protecting your firm from regulatory risk—you're positioning it for long-term success in an increasingly competitive marketplace.

Ready to build your compliance technology stack? RIA Compliance Technology specializes in helping newly registered advisory firms implement cost-effective, automated compliance solutions. Contact us today to schedule a consultation and discover how the right technology can transform your compliance burden into a competitive advantage.

References

- https://advisorlawllc.com/how-much-does-it-cost-to-set-up-an-ria/

- https://www.institutionalinvestor.com/article/2dykyorriwfkkd7bubsow/ria-intel/technology-brings-relief-to-advisors-wrestling-with-regulatory-compliance

- https://smart-ria.com/blog/from-fines-to-efficiency-how-rias-are-winning-with-compliance-automation-in-2025/

- https://www.comply.com/resource/meeting-significant-ria-compliance-challenges-as-a-small-advisory-firm/

- https://www.kitces.com/blog/compliance-calendar-for-a-solo-ria-nasaa-model-rules-adv-annual-amendment/

- https://www.lpl.com/join-lpl/why-choose-lpl/news-and-insights/calculating-the-cost-of-compliance-for-rias.html

- https://www.scribbl.co/post/registered-investment-advisor-ria-complete-guide-to-definition-becoming-an-ria-regulations-fees-and-industry-trends

- https://www.ria-compliance-consultants.com/ria_express_investment_advisor_compliance_tools/online_store_investment_adviser_manual_forms_webinars/

- https://lucinity.com/blog/5-proven-strategies-to-cut-compliance-costs-for-small-businesses

- https://www.comply.com/resource/how-much-does-it-cost-to-start-an-ria-firm/

Tags

Blake Bjordahl

Compliance Technology Expert & RIA Consultant

Blake specializes in helping RIAs implement cost-effective compliance solutions. With extensive experience in regulatory technology, he focuses on making compliance simple and automated for investment advisory firms.

Ready to Simplify Your Compliance Management?

Stop worrying about compliance tasks and start focusing on what matters most - your clients. Get organized with our compliance calendar solution.